SI 142 to impact negatively on council finances: Mayor

By Albert Nxumalo

The controversial Statutory Instrument 142 promulgated by Government in June which resulted in the Reserve Bank of Zimbabwe hiking interest rate from 15 percent per annum to 50 percent per annum will negatively impact Bulawayo City Council`s financial performance which may lead to loan repayment instalments doubling up, a senior official has said.

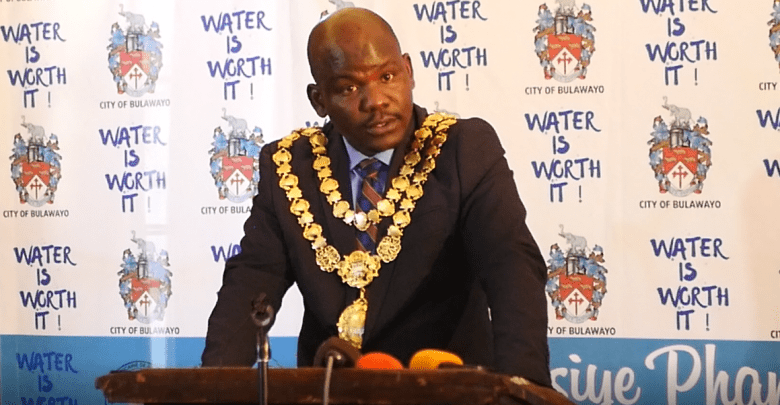

Outlining his service delivery update on Wednesday, city mayor Solomon Mguni painted a gloomy outlook borne out of the statutory instrument.

Mguni said the constant changes in the economic environment such as the SI 142 of 2019 have had an impact on the financial performance of the local authority.

“Some of the notable impacts of the proclamation include the interest of overnight accommodation of banks by Reserve Bank of Zimbabwe being set at 50% per annum,” said Mguni.

“It is noted that this is likely to push interest to above 50% per annum affecting interests for BCC loans charges.

“It is noted that if the interest rates are increased in line with the inflation trends we will have monthly loan repayment instalments doubling up and these costs will exceed the budget”.

According to the city mayor, the repayment will also crowd out the cash flow requirements for service provision.

“To try and sustain this, the Council will need to increase the interest rates for the amounts it is owed.

“Council, however, does not have the latitude to increase the interest rate to above 1% of the government lending rate of 5%”, said Mguni.

To address the pending crisis, Mguni said there was a need for “the municipality to lobby government for the review of interest rates to track the rate of inflation to ensure sustainability”.

In a public notice at the end of June, RBZ Governor, Dr John Mangudya, announced the adjustment, with effect from 24 June 2019, in “the interest rate on the Reserve Bank overnight window upwards from the current 15 percent per annum to 50 percent per annum”.

That meant as banks borrow from the central bank at the repo-rate of 50 percent interest, they will on-lend to their clients or customers at 50 percent-plus rate.

The interest rate is the amount charged, expressed as a percentage of the principal, by a lender to a borrower, typically noted on an annual basis.

However, some market watchers felt the 50 percent interest rate was rather too steep and risks frustrating borrowing for productive

purposes by companies.

Others feared the new lending rate level would be a double-edged sword on account of banks and businesses possibly passing the borrowing burden to end consumers.

While Mguni said government policies pose a danger to council financial health, he blamed residents and parastatals for added to the woes by not paying their debts.

The debts which stood at $189 million in May “puts the City’s operations at risk and impacts on service delivery” he said.

“Regrettably, some consumers continue to not prioritise the payment of critical life-supporting services such as water, sewerage, and refuse removal, while unemployment and poverty have further impacted on consumers ability to pay Council.

“Debtors as at May 2019 were one hundred and eighty nine million dollars ($189, 297,693) with the domestic consumers owing a large chunk of the money at one hundred and eleven million dollars ($111,132,763), while industry owed seventy-one million dollars ($71.310.633), parastatals, three million dollars ($3,868, 246) and Government owing $2,986,051” said Clr Mguni.

As part of efforts to recover outstanding debts, Mguni said they will “collect the outstanding funds through various collection strategies which include bills, notices to remind consumers of owed amounts, intensive disconnection programmes, sector-wide debt collection programmes and intensifying collections through legal channels”.

On water, the supply dams holding capacity is now at 47.85 percent.

Mguni said Umzingwane is at 21.03 percent and will be decommissioned in November 2019.

Bulawayo’s residential suburbs are under a 96-hour water shedding regime, which commenced on 2 July and will run up to Saturday 6th July 2019.

Regarding the city road network, rehabilitation and maintenance programmes face a financial squeeze as funding is below maintenance requirements, added the mayor.

Mguni said the erratic supply of bitumen due to foreign currency challenges, erratic fuel shortages, bureaucratic requirements under the new Procurement Act and contract price escalations are some of the challenges encountered.

” Furthermore, contractors now require advance payment for mobilisation and procurement of materials. Under the prevailing economic environment, the Council is focusing on maintaining the existing road network and has minimised the construction of new roads”.